How Eagle Mountain City Passed the RAP Tax with Strategic Public Relations and Community Engagement

Client Background

One of Utah’s fastest-growing cities, Eagle Mountain has a population exceeding 70,000 with a long-term projection of more than 200,000. This accelerated growth encouraged city leaders to propose a Recreation, Arts, and Parks (RAP) Tax, which would directly affect the quality of life and support open spaces in their community.

A proposal for the tax to be placed on the November ballot in August 2025 was successful. Utah Valley requires each city to vote on and establish the tax individually and Eagle Mountain was one of the few without it. Careful communication within strict legal guidelines that limit municipal advocacy was required for both city and XL PR team members to abide by. The City needed a partner that could balance education, persuasion, transparency, and compliance while building trust with residents across diverse demographics.

Research

XL PR began with a comprehensive research phase to understand the political landscape, community sentiment and legal constraints surrounding the RAP Tax. Interviews of the city leadership team, a review of the community Facebook group, reading the city website which housed a community newsroom and past media monitoring efforts were all part of this process. Previous primary research and supporting marketing materials were reviewed as a part of the research phase.

The research revealed that while many residents valued parks and recreation, confusion around taxation and skepticism toward government initiatives posed a significant barrier. The strategy needed to be highly accessible, hyper-local, and grounded in clear facts.

Using research insights, XL PR developed a multi-phase communications plan that aligned with government law regulations of what could and couldn’t be done at certain times of the campaign schedule. The goal was to pass the Tax with over 50% approval.

The phased plan included three parts:

Writing a Strategic Communication Plan

Persuasion

Education

The Strategic Communications Plan was drafted to include key publics in the community (i.e. young families, longtime residents, retirees, small business owners, and bilingual households) to tailor messaging without fragmenting the campaign. Message architecture created a central narrative that explained what the RAP Tax is, what it is not (not a property tax), and how funds would be used without assuming voter support. The campaign was planned to be implemented across a variety of channels: earned media, digital content, print materials, events, and stakeholder toolkits into a cohesive system.

This planning phase ensured that every tactic reinforced clarity, credibility, and compliance.

Planning

Implementation

In the persuasion phase of the campaign, the tactics were created and released according to a calendar. Ten pieces of content were drafted in persuasion and education language for each phase of the campaign from landing pages, a campaign educational video, a voter’s brochure and one-sheeters.

After the tax was put on the ballot in August, an education phase of the campaign began. Across both phases of the campaign, an omnichannel approach was executed by both partners while coordinating daily to manage appropriate message execution for each phase.

Educational content development: Creation of 10+ core assets, including a press kit, FAQ documents, a voter education brochure, campaign video, fact sheets, and a RAP Tax landing page

Media relations: Strategic pitching to local outlets resulted in sustained coverage explaining the RAP Tax’s purpose, structure, and local relevance

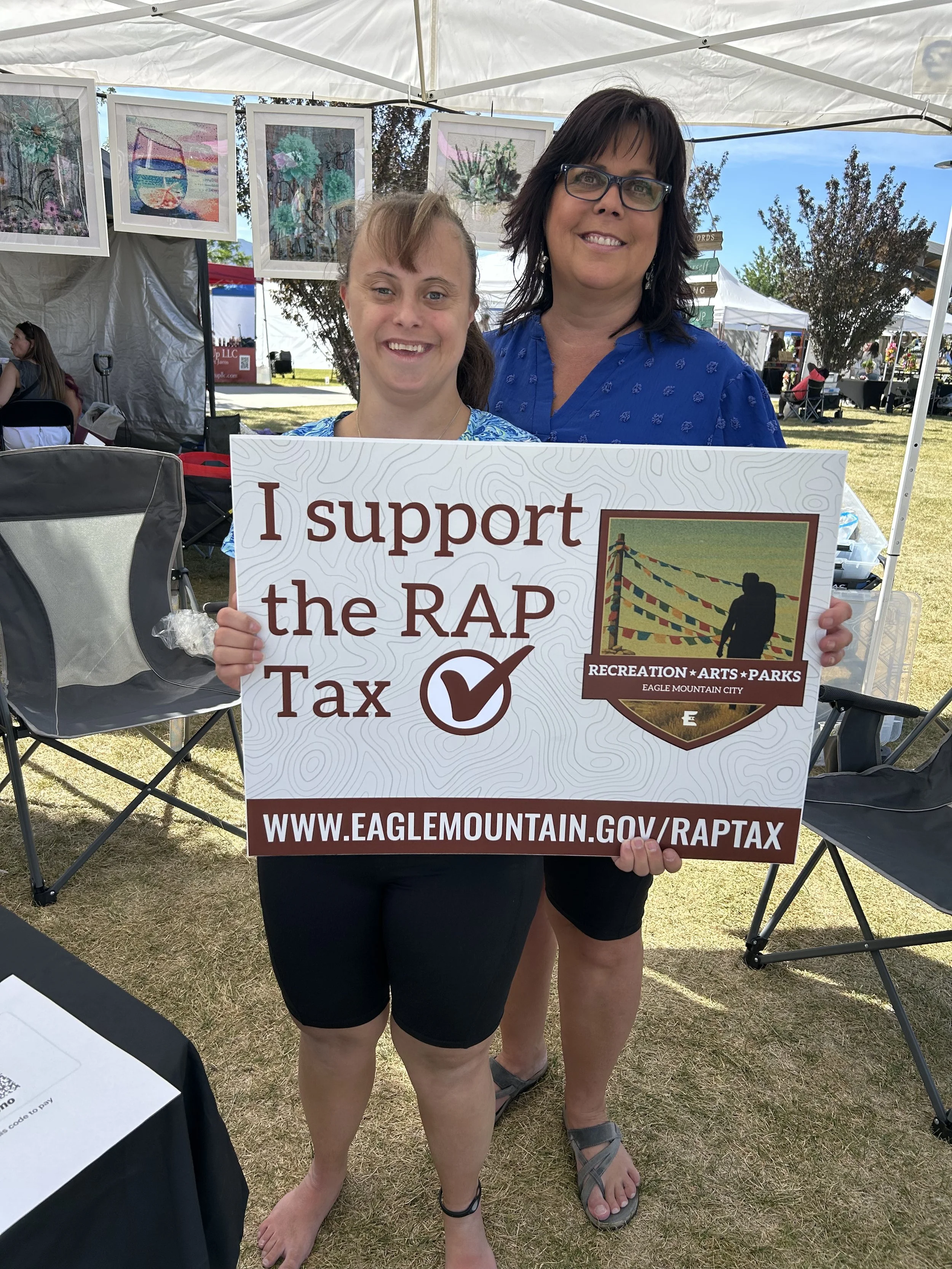

Community engagement: On-the-ground presence at farmers’ markets and events, supported by clear, easy-to-understand materials

Digital and social strategy: Coordinated messaging across city channels to maximize reach while maintaining an informational tone

Stakeholder toolkit: Providing community leaders, nonprofits, and advocates with accurate, ready-to-use information to share independently

Risk management and crisis clarification response: Quickly addressing misinformation (such as confusion around a proposed recreation center) with timely, factual communications

Client Endorsement

“This was an uphill climb from the start, and the RAP Tax was met with strong criticism and opposition, but success was accomplished with creativity, hard work, and integrity. I just wanted to say what a privilege it has been to work with the XL-PR team. You have earned our admiration for your efforts, your recommendations, and your guidance throughout the process. More importantly, each of you are good and kind people, and I don’t think that’s mentioned enough in the professional setting. Eagle Mountain City made the right choice when hiring you.”

Results

The campaign concluded with a successful vote and measurable communication outcomes.

RAP Tax passed with 57.82% voter approval, exceeding the required simple majority

17 earned media placements across digital, print, broadcast, and social outlets, including KSL, Daily Herald, and Utah Business

10 educational content pieces produced to support voter understanding

53,284 engagements, 500,600 reach, and 6+ million impressions across digital and social platforms

Strong participation at in-person community events with positive feedback